“Blessed is the nation that doesn’t need heroes" Goethe. “Hero-worship is strongest where there is least regard for human freedom.” Herbert Spencer

Search This Blog

Showing posts with label banks. Show all posts

Showing posts with label banks. Show all posts

Thursday 6 January 2022

Monday 14 September 2020

Sunday 22 March 2020

Wartime finance fit for wartime economic conditions. Sunak as British Prime Minister?

Rishi Sunak’s coronavirus rescue package is crucial for a collapsing economy. Social partnership is back writes Will Hutton in The Guardian

Food queues at Covent Garden market in London during the Second World War. Photograph: Trinity Mirror/Mirrorpix/Alamy Stock Photo

Last week, the British economic and financial system came very close to breakdown. An extraordinary number of companies were, and are, in acute financial distress, threatening mass lay-offs and the cessation of swathes of economic activity. There was an almost complete collapse in investor confidence, with attempts to sell every financial asset – even high-quality government bonds – in a desperate quest to hold cash. Such was the loss of generalised faith in the integrity of the system that the governor of the Bank of England, Andrew Bailey, came close to shutting the financial markets.

The scale of the incredible drama – much more acute than the financial crisis of September 2008 and still unfolding – only commanded half our attention. Most eyes understandably were focused on the march of the coronavirus and the missteps and miscommunications of a prime minister unsuited for the leadership demands of high office.

The confusion and growing public panic at the uncertain response was amplified manyfold in the financial markets, matched by fear and uncertainty in the real economy that produces the goods and services we want and need. The Treasury and the Bank of England stared into an abyss. Thankfully their officials, derided by the cabal of second-rate ideologue advisers at Number 10, were up to the task.

Here Boris Johnson – and the country – got lucky. The Conservative party, broken by the triumph of anti-EU ideology and the wilful disregard for fact that is the hallmark of the Brexiter mindset, now offers the weakest talent pool in its long history. But the chancellor, Rishi Sunak, is an unexpected outlier. Officials report that he is proving highly intelligent, economically literate, agile and with acutely sensitive political antennae. Thus the unprecedented interventions last week – with much more to come in the weeks ahead.

Even as I write, the Treasury and the Bank are in urgent talks to organise bailout packages for a number of top companies (including, but not only, airlines), sometimes taking government share stakes along the lines of the bailout of RBS in 2008.

But it was only last Monday that the government genuinely thought that if it stood behind business with a massive programme of soft loans, with grants for hard-hit sectors, it might escape without having to go much further. It did not need to sully its hands with un-Tory propositions – underwriting worker incomes together with improved benefits for those thrown out of work.

However, the crisis of confidence in the financial markets and intense lobbying by the CBI and the TUC soon changed minds, none faster than the initially sceptical Sunak. After all, business cannot prosper without buyers for its products: the good health and predictable incomes of the working population are vital. The last vestiges of Thatcherite individualism are being torched. Social partnership is back with a vengeance

Meanwhile, the top echelons of the Bank of England witnessed the consequences of the outbreak as mounting panic in global trading hit British markets badly, all magnified by Johnson’s bumbles. The sterling crisis expected with a no-deal Brexit was brought forward: a currency dependent on the “kindness of strangers”, given the scale of Britain’s monumental international balance of payments deficit, was in near freefall. There had to be a twin response: a fiscal one that “would blow the bloody wall down” and a shock-and-awe monetary intervention to try to steady shattered bond markets.

The Bank moved first, committing to a £200bn programme of printing money to buy bonds (quantitative easing) and cutting interest rates to a symbolic 0.1%. For the moment, the markets have steadied. Then came Sunak’s measures, the centrepiece of which was the commitment to pay 80% of the wages (up to £2,500 a month) of workers threatened by lay-off. He also ratcheted up support for renters and those on universal credit.

Two million people working in the now shut hospitality sector will be immediately eligible, along with up to five million more as the economy contracts by at least one fifth in the months ahead, with the expected package for the self-employed adding yet more. At its peak, the cost per month will exceed £25bn and the scheme will plainly need extending. The budget deficit in 2020-21 will comfortably exceed £200bn, to be financed, if necessary, by the Bank of England printing money. There are no other options. One privy to the policy told me that even at the last they were unsure whether Sunak “had the balls”. He did. It is what had to be done – and is being reproduced across Europe and North America.

It is wartime finance for wartime economic conditions. Over and above the multiple bailout packages currently being negotiated will come state direction and manufacture of vaccines, key medical products, respirators, and the takeover of private hospitals. Key workers – in the NHS, police, transport and food supply chain – will have to be marshalled in their millions and their wellbeing and health protected. Rationing of key foodstuffs will need to be imposed. The only way to head off a full-scale collapse of sterling and protracted economic depression will be to defer Brexit for at least a year or, as one source told me, five years. Government communications will have to be infinitely more sure-footed. The government itself has to be 100% trusted.

The open question is whether Johnson’s government, with its “frighteningly weak” core at Number 10, as one insider reported to me, can do what is necessary. If not there will, as in wartime, have to be a national government (headed by Sunak with Keir Starmer as his deputy). Johnson is too divisive a figure, too thin-skinned, too unserious in his messaging and with too divisive a history, to lead.

Sunak and Starmer offer competence and humanity above ideology. Whether through the deferral of Brexit or smart and well-thought-through state direction of the economy, they will do what is needed to get us through. In the meantime, take social distancing seriously. Be one of those who put society and social obligations first. And stay safe.

Last week, the British economic and financial system came very close to breakdown. An extraordinary number of companies were, and are, in acute financial distress, threatening mass lay-offs and the cessation of swathes of economic activity. There was an almost complete collapse in investor confidence, with attempts to sell every financial asset – even high-quality government bonds – in a desperate quest to hold cash. Such was the loss of generalised faith in the integrity of the system that the governor of the Bank of England, Andrew Bailey, came close to shutting the financial markets.

The scale of the incredible drama – much more acute than the financial crisis of September 2008 and still unfolding – only commanded half our attention. Most eyes understandably were focused on the march of the coronavirus and the missteps and miscommunications of a prime minister unsuited for the leadership demands of high office.

The confusion and growing public panic at the uncertain response was amplified manyfold in the financial markets, matched by fear and uncertainty in the real economy that produces the goods and services we want and need. The Treasury and the Bank of England stared into an abyss. Thankfully their officials, derided by the cabal of second-rate ideologue advisers at Number 10, were up to the task.

Here Boris Johnson – and the country – got lucky. The Conservative party, broken by the triumph of anti-EU ideology and the wilful disregard for fact that is the hallmark of the Brexiter mindset, now offers the weakest talent pool in its long history. But the chancellor, Rishi Sunak, is an unexpected outlier. Officials report that he is proving highly intelligent, economically literate, agile and with acutely sensitive political antennae. Thus the unprecedented interventions last week – with much more to come in the weeks ahead.

Even as I write, the Treasury and the Bank are in urgent talks to organise bailout packages for a number of top companies (including, but not only, airlines), sometimes taking government share stakes along the lines of the bailout of RBS in 2008.

But it was only last Monday that the government genuinely thought that if it stood behind business with a massive programme of soft loans, with grants for hard-hit sectors, it might escape without having to go much further. It did not need to sully its hands with un-Tory propositions – underwriting worker incomes together with improved benefits for those thrown out of work.

However, the crisis of confidence in the financial markets and intense lobbying by the CBI and the TUC soon changed minds, none faster than the initially sceptical Sunak. After all, business cannot prosper without buyers for its products: the good health and predictable incomes of the working population are vital. The last vestiges of Thatcherite individualism are being torched. Social partnership is back with a vengeance

Meanwhile, the top echelons of the Bank of England witnessed the consequences of the outbreak as mounting panic in global trading hit British markets badly, all magnified by Johnson’s bumbles. The sterling crisis expected with a no-deal Brexit was brought forward: a currency dependent on the “kindness of strangers”, given the scale of Britain’s monumental international balance of payments deficit, was in near freefall. There had to be a twin response: a fiscal one that “would blow the bloody wall down” and a shock-and-awe monetary intervention to try to steady shattered bond markets.

The Bank moved first, committing to a £200bn programme of printing money to buy bonds (quantitative easing) and cutting interest rates to a symbolic 0.1%. For the moment, the markets have steadied. Then came Sunak’s measures, the centrepiece of which was the commitment to pay 80% of the wages (up to £2,500 a month) of workers threatened by lay-off. He also ratcheted up support for renters and those on universal credit.

Two million people working in the now shut hospitality sector will be immediately eligible, along with up to five million more as the economy contracts by at least one fifth in the months ahead, with the expected package for the self-employed adding yet more. At its peak, the cost per month will exceed £25bn and the scheme will plainly need extending. The budget deficit in 2020-21 will comfortably exceed £200bn, to be financed, if necessary, by the Bank of England printing money. There are no other options. One privy to the policy told me that even at the last they were unsure whether Sunak “had the balls”. He did. It is what had to be done – and is being reproduced across Europe and North America.

It is wartime finance for wartime economic conditions. Over and above the multiple bailout packages currently being negotiated will come state direction and manufacture of vaccines, key medical products, respirators, and the takeover of private hospitals. Key workers – in the NHS, police, transport and food supply chain – will have to be marshalled in their millions and their wellbeing and health protected. Rationing of key foodstuffs will need to be imposed. The only way to head off a full-scale collapse of sterling and protracted economic depression will be to defer Brexit for at least a year or, as one source told me, five years. Government communications will have to be infinitely more sure-footed. The government itself has to be 100% trusted.

The open question is whether Johnson’s government, with its “frighteningly weak” core at Number 10, as one insider reported to me, can do what is necessary. If not there will, as in wartime, have to be a national government (headed by Sunak with Keir Starmer as his deputy). Johnson is too divisive a figure, too thin-skinned, too unserious in his messaging and with too divisive a history, to lead.

Sunak and Starmer offer competence and humanity above ideology. Whether through the deferral of Brexit or smart and well-thought-through state direction of the economy, they will do what is needed to get us through. In the meantime, take social distancing seriously. Be one of those who put society and social obligations first. And stay safe.

Monday 8 May 2017

The great British Brexit robbery: how our democracy was hijacked

by Carole Cadwalladr in The Guardian

“The connectivity that is the heart of globalisation can be exploited by states with hostile intent to further their aims.[…] The risks at stake are profound and represent a fundamental threat to our sovereignty.”

Alex Younger, head of MI6, December, 2016

Alex Younger, head of MI6, December, 2016

“It’s not MI6’s job to warn of internal threats. It was a very strange speech. Was it one branch of the intelligence services sending a shot across the bows of another? Or was it pointed at Theresa May’s government? Does she know something she’s not telling us?”

Senior intelligence analyst, April 2017

Senior intelligence analyst, April 2017

In June 2013, a young American postgraduate called Sophie was passing through London when she called up the boss of a firm where she’d previously interned. The company, SCL Elections, went on to be bought by Robert Mercer, a secretive hedge fund billionaire, renamed Cambridge Analytica, and achieved a certain notoriety as the data analytics firm that played a role in both Trump and Brexit campaigns. But all of this was still to come. London in 2013 was still basking in the afterglow of the Olympics. Britain had not yet Brexited. The world had not yet turned.

“That was before we became this dark, dystopian data company that gave the world Trump,” a former Cambridge Analytica employee who I’ll call Paul tells me. “It was back when we were still just a psychological warfare firm.”

Was that really what you called it, I ask him. Psychological warfare? “Totally. That’s what it is. Psyops. Psychological operations – the same methods the military use to effect mass sentiment change. It’s what they mean by winning ‘hearts and minds’. We were just doing it to win elections in the kind of developing countries that don’t have many rules.”

Why would anyone want to intern with a psychological warfare firm, I ask him. And he looks at me like I am mad. “It was like working for MI6. Only it’s MI6 for hire. It was very posh, very English, run by an old Etonian and you got to do some really cool things. Fly all over the world. You were working with the president of Kenya or Ghana or wherever. It’s not like election campaigns in the west. You got to do all sorts of crazy shit.”

On that day in June 2013, Sophie met up with SCL’s chief executive, Alexander Nix, and gave him the germ of an idea. “She said, ‘You really need to get into data.’ She really drummed it home to Alexander. And she suggested he meet this firm that belonged to someone she knew about through her father.”

Who’s her father?

“Eric Schmidt.”

Eric Schmidt – the chairman of Google?

“Yes. And she suggested Alexander should meet this company called Palantir.”

I had been speaking to former employees of Cambridge Analytica for months and heard dozens of hair-raising stories, but it was still a gobsmacking moment. To anyone concerned about surveillance, Palantir is practically now a trigger word. The data-mining firm has contracts with governments all over the world – including GCHQ and the NSA. It’s owned by Peter Thiel, the billionaire co-founder of eBay and PayPal, who became Silicon Valley’s first vocal supporter of Trump.

In some ways, Eric Schmidt’s daughter showing up to make an introduction to Palantir is just another weird detail in the weirdest story I have ever researched.

A weird but telling detail. Because it goes to the heart of why the story of Cambridge Analytica is one of the most profoundly unsettling of our time. Sophie Schmidt now works for another Silicon Valley megafirm: Uber. And what’s clear is that the power and dominance of the Silicon Valley – Google and Facebook and a small handful of others – are at the centre of the global tectonic shift we are currently witnessing.

The money man: Robert Mercer, Trump supporter and owner of Cambridge Analytica. Photograph: Rex

It also reveals a critical and gaping hole in the political debate in Britain. Because what is happening in America and what is happening in Britain are entwined. Brexit and Trump are entwined. The Trump administration’s links to Russia and Britain are entwined. And Cambridge Analytica is one point of focus through which we can see all these relationships in play; it also reveals the elephant in the room as we hurtle into a general election: Britain tying its future to an America that is being remade - in a radical and alarming way - by Trump.

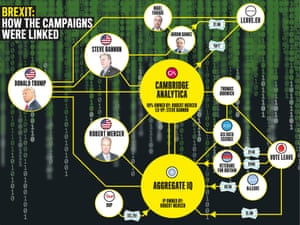

There are three strands to this story. How the foundations of an authoritarian surveillance state are being laid in the US. How British democracy was subverted through a covert, far-reaching plan of coordination enabled by a US billionaire. And how we are in the midst of a massive land grab for power by billionaires via our data. Data which is being silently amassed, harvested and stored. Whoever owns this data owns the future.

My entry point into this story began, as so many things do, with a late-night Google. Last December, I took an unsettling tumble into a wormhole of Google autocompletesuggestions that ended with “did the holocaust happen”. And an entire page of results that claimed it didn’t.

Google’s algorithm had been gamed by extremist sites and it was Jonathan Albright, a professor of communications at Elon University, North Carolina, who helped me get to grips with what I was seeing. He was the first person to map and uncover an entire “alt-right” news and information ecosystem and he was the one who first introduced me to Cambridge Analytica.

He called the company a central point in the right’s “propaganda machine”, a line I quoted in reference to its work for the Trump election campaign and the referendum Leave campaign. That led to the second article featuring Cambridge Analytica – as a central node in the alternative news and information network that I believed Robert Mercer and Steve Bannon, the key Trump aide who is now his chief strategist, were creating. I found evidence suggesting they were on a strategic mission to smash the mainstream media and replace it with one comprising alternative facts, fake history and rightwing propaganda.

Mercer is a brilliant computer scientist, a pioneer in early artificial intelligence, and the co-owner of one of the most successful hedge funds on the planet (with a gravity-defying 71.8% annual return). And, he is also, I discovered, good friends with Nigel Farage. Andy Wigmore, Leave.EU’s communications director, told me that it was Mercer who had directed his company, Cambridge Analytica, to “help” the Leave campaign.

The second article triggered two investigations, which are both continuing: one by the Information Commissioner’s Office into the possible illegal use of data. And a second by the Electoral Commission which is “focused on whether one or more donations – including services – accepted by Leave.EU was ‘impermissable’”.

What I then discovered is that Mercer’s role in the referendum went far beyond this. Far beyond the jurisdiction of any UK law. The key to understanding how a motivated and determined billionaire could bypass ourelectoral laws rests on AggregateIQ, an obscure web analytics company based in an office above a shop in Victoria, British Columbia.

It was with AggregateIQ that Vote Leave (the official Leave campaign) chose to spend £3.9m, more than half its official £7m campaign budget. As did three other affiliated Leave campaigns: BeLeave, Veterans for Britain and the Democratic Unionist party, spending a further £757,750. “Coordination” between campaigns is prohibited under UK electoral law, unless campaign expenditure is declared, jointly. It wasn’t. Vote Leave says the Electoral Commission “looked into this” and gave it “a clean bill of health”.

How did an obscure Canadian company come to play such a pivotal role in Brexit? It’s a question that Martin Moore, director of the centre for the study of communication, media and power at King’s College London has been asking too. “I went through all the Leave campaign invoices when the Electoral Commission uploaded them to its site in February. And I kept on discovering all these huge amounts going to a company that not only had I never heard of, but that there was practically nothing at all about on the internet. More money was spent with AggregateIQ than with any other company in any other campaign in the entire referendum. All I found, at that time, was a one-page website and that was it. It was an absolute mystery.”

Moore contributed to an LSE report published in April that concluded UK’s electoral laws were “weak and helpless” in the face of new forms of digital campaigning. Offshore companies, money poured into databases, unfettered third parties… the caps on spending had come off. The laws that had always underpinned Britain’s electoral laws were no longer fit for purpose. Laws, the report said, that needed “urgently reviewing by parliament”.

AggregateIQ holds the key to unravelling another complicated network of influence that Mercer has created. A source emailed me to say he had found that AggregateIQ’s address and telephone number corresponded to a company listed on Cambridge Analytica’s website as its overseas office: “SCL Canada”. A day later, that online reference vanished.

There had to be a connection between the two companies. Between the various Leave campaigns. Between the referendum and Mercer. It was too big a coincidence. But everyone – AggregateIQ, Cambridge Analytica, Leave.EU, Vote Leave – denied it. AggregateIQ had just been a short-term “contractor” to Cambridge Analytica. There was nothing to disprove this. We published the known facts. On 29 March, article 50 was triggered.

Then I meet Paul, the first of two sources formerly employed by Cambridge Analytica. He is in his late 20s and bears mental scars from his time there. “It’s almost like post-traumatic shock. It was so… messed up. It happened so fast. I just woke up one morning and found we’d turned into the Republican fascist party. I still can’t get my head around it.”

He laughed when I told him the frustrating mystery that was AggregateIQ. “Find Chris Wylie,” he said.

Who’s Chris Wylie?

“He’s the one who brought data and micro-targeting [individualised political messages] to Cambridge Analytica. And he’s from west Canada. It’s only because of him that AggregateIQ exist. They’re his friends. He’s the one who brought them in.”

There wasn’t just a relationship between Cambridge Analytica and AggregateIQ, Paul told me. They were intimately entwined, key nodes in Robert Mercer’s distributed empire. “The Canadians were our back office. They built our software for us. They held our database. If AggregateIQ is involved then Cambridge Analytica is involved. And if Cambridge Analytica is involved, then Robert Mercer and Steve Bannon are involved. You need to find Chris Wylie.”

I did find Chris Wylie. He refused to comment.

Key to understanding how data would transform the company is knowing where it came from. And it’s a letter from “Director of Defence Operations, SCL Group”, that helped me realise this. It’s from “Commander Steve Tatham, PhD, MPhil, Royal Navy (rtd)” complaining about my use in my Mercer article of the word “disinformation”.

I wrote back to him pointing out references in papers he’d written to “deception” and “propaganda”, which I said I understood to be “roughly synonymous with ‘disinformation’.” It’s only later that it strikes me how strange it is that I’m corresponding with a retired navy commander about military strategies that may have been used in British and US elections.

What’s been lost in the US coverage of this “data analytics” firm is the understanding of where the firm came from: deep within the military-industrial complex. A weird British corner of it populated, as the military establishment in Britain is, by old-school Tories. Geoffrey Pattie, a former parliamentary under-secretary of state for defence procurement and director of Marconi Defence Systems, used to be on the board, and Lord Marland, David Cameron’s pro-Brexit former trade envoy, a shareholder.

Steve Tatham was the head of psychological operations for British forces in Afghanistan. The Observer has seen letters endorsing him from the UK Ministry of Defence, the Foreign Office and Nato.

SCL/Cambridge Analytica was not some startup created by a couple of guys with a Mac PowerBook. It’s effectively part of the British defence establishment. And, now, too, the American defence establishment. An ex-commanding officer of the US Marine Corps operations centre, Chris Naler, has recently joined Iota Global, a partner of the SCL group.

This is not just a story about social psychology and data analytics. It has to be understood in terms of a military contractor using military strategies on a civilian population. Us. David Miller, a professor of sociology at Bath University and an authority in psyops and propaganda, says it is “an extraordinary scandal that this should be anywhere near a democracy. It should be clear to voters where information is coming from, and if it’s not transparent or open where it’s coming from, it raises the question of whether we are actually living in a democracy or not.”

Paul and David, another ex-Cambridge Analytica employee, were working at the firm when it introduced mass data-harvesting to its psychological warfare techniques. “It brought psychology, propaganda and technology together in this powerful new way,” David tells me.

Steve Bannon, former vice-president of Cambridge Analytica, now a key adviser to Donald Trump. Photograph: Jonathan Ernst/Reuters

And it was Facebook that made it possible. It was from Facebook that Cambridge Analytica obtained its vast dataset in the first place. Earlier, psychologists at Cambridge University harvested Facebook data (legally) for research purposes and published pioneering peer-reviewed work about determining personality traits, political partisanship, sexuality and much more from people’s Facebook “likes”. And SCL/Cambridge Analytica contracted a scientist at the university, Dr Aleksandr Kogan, to harvest new Facebook data. And he did so by paying people to take a personality quiz which also allowed not just their own Facebook profiles to be harvested, but also those of their friends – a process then allowed by the social network.

Facebook was the source of the psychological insights that enabled Cambridge Analytica to target individuals. It was also the mechanism that enabled them to be delivered on a large scale.

The company also (perfectly legally) bought consumer datasets – on everything from magazine subscriptions to airline travel – and uniquely it appended these with the psych data to voter files. It matched all this information to people’s addresses, their phone numbers and often their email addresses. “The goal is to capture every single aspect of every voter’s information environment,” said David. “And the personality data enabled Cambridge Analytica to craft individual messages.”

Finding “persuadable” voters is key for any campaign and with its treasure trove of data, Cambridge Analytica could target people high in neuroticism, for example, with images of immigrants “swamping” the country. The key is finding emotional triggers for each individual voter.

Cambridge Analytica worked on campaigns in several key states for a Republican political action committee. Its key objective, according to a memo the Observer has seen, was “voter disengagement” and “to persuade Democrat voters to stay at home”: a profoundly disquieting tactic. It has previously been claimed that suppression tactics were used in the campaign, but this document provides the first actual evidence.

But does it actually work? One of the criticisms that has been levelled at my and others’ articles is that Cambridge Analytica’s “special sauce” has been oversold. Is what it is doing any different from any other political consultancy?

“It’s not a political consultancy,” says David. “You have to understand this is not a normal company in any way. I don’t think Mercer even cares if it ever makes any money. It’s the product of a billionaire spending huge amounts of money to build his own experimental science lab, to test what works, to find tiny slivers of influence that can tip an election. Robert Mercer did not invest in this firm until it ran a bunch of pilots – controlled trials. This is one of the smartest computer scientists in the world. He is not going to splash $15m on bullshit.”

Tamsin Shaw, an associate professor of philosophy at New York University, helps me understand the context. She has researched the US military’s funding and use of psychological research for use in torture. “The capacity for this science to be used to manipulate emotions is very well established. This is military-funded technology that has been harnessed by a global plutocracy and is being used to sway elections in ways that people can’t even see, don’t even realise is happening to them,” she says. “It’s about exploiting existing phenomenon like nationalism and then using it to manipulate people at the margins. To have so much data in the hands of a bunch of international plutocrats to do with it what they will is absolutely chilling.

“We are in an information war and billionaires are buying up these companies, which are then employed to go to work in the heart of government. That’s a very worrying situation.”

A project that Cambridge Analytica carried out in Trinidad in 2013 brings all the elements in this story together. Just as Robert Mercer began his negotiations with SCL boss Alexander Nix about an acquisition, SCL was retained by several government ministers in Trinidad and Tobago. The brief involved developing a micro-targeting programme for the governing party of the time. And AggregateIQ – the same company involved in delivering Brexit for Vote Leave – was brought in to build the targeting platform.

David said: “The standard SCL/CA method is that you get a government contract from the ruling party. And this pays for the political work. So, it’s often some bullshit health project that’s just a cover for getting the minister re-elected. But in this case, our government contacts were with Trinidad’s national security council.”

The security work was to be the prize for the political work. Documents seen by the Observer show that this was a proposal to capture citizens’ browsing history en masse, recording phone conversations and applying natural language processing to the recorded voice data to construct a national police database, complete with scores for each citizen on their propensity to commit crime.

“The plan put to the minister was Minority Report. It was pre-crime. And the fact that Cambridge Analytica is now working inside the Pentagon is, I think, absolutely terrifying,” said David.

These documents throw light on a significant and under-reported aspect of the Trump administration. The company that helped Trump achieve power in the first place has now been awarded contracts in the Pentagon and the US state department. Its former vice-president Steve Bannon now sits in the White House. It is also reported to be in discussions for “military and homeland security work”.

In the US, the government is bound by strict laws about what data it can collect on individuals. But, for private companies anything goes. Is it unreasonable to see in this the possible beginnings of an authoritarian surveillance state?

A state that is bringing corporate interests into the heart of the administration. Documents detail Cambridge Analytica is involved with many other right-leaning billionaires, including Rupert Murdoch. One memo references Cambridge Analytica trying to place an article with a journalist in Murdoch’s Wall Street Journal: “RM re-channeled and connected with Jamie McCauley from Robert Thomson News Corp office,” it says.

It makes me think again about the story involving Sophie Schmidt, Cambridge Analytica and Palantir. Is it a telling detail, or is it a clue to something else going on? Cambridge Analytica and Palantir both declined to comment for this article on whether they had any relationship. But witnesses and emails confirm that meetings between Cambridge Analytica and Palantir took place in 2013. The possibility of a working relationship was at least discussed.

Further documents seen by the Observer confirm that at least one senior Palantir employee consulted with Cambridge Analytica in relation to the Trinidad project and later political work in the US. But at the time, I’m told, Palantir decided it was too much of a reputational risk for a more formal arrangement. There was no upside to it. Palantir is a company that is trusted to handle vast datasets on UK and US citizens for GCHQ and the NSA, as well as many other countries.

Now though, they are both owned by ideologically aligned billionaires: Robert Mercer and Peter Thiel. The Trump campaign has said that Thiel helped it with data. A campaign that was led by Steve Bannon, who was then at Cambridge Analytica.

A leading QC who spends a lot of time in the investigatory powers tribunal said that the problem with this technology was that it all depended on whose hands it was in.

“On the one hand, it’s being done by companies and governments who say ‘you can trust us, we are good and democratic and bake cakes at the weekend’. But then the same expertise can also be sold on to whichever repressive regime.”

In Britain, we still trust our government. We respect our authorities to uphold our laws. We trust the rule of law. We believe we live in a free and fair democracy. Which is what, I believe, makes the last part of this story so profoundly unsettling.

And it was Facebook that made it possible. It was from Facebook that Cambridge Analytica obtained its vast dataset in the first place. Earlier, psychologists at Cambridge University harvested Facebook data (legally) for research purposes and published pioneering peer-reviewed work about determining personality traits, political partisanship, sexuality and much more from people’s Facebook “likes”. And SCL/Cambridge Analytica contracted a scientist at the university, Dr Aleksandr Kogan, to harvest new Facebook data. And he did so by paying people to take a personality quiz which also allowed not just their own Facebook profiles to be harvested, but also those of their friends – a process then allowed by the social network.

Facebook was the source of the psychological insights that enabled Cambridge Analytica to target individuals. It was also the mechanism that enabled them to be delivered on a large scale.

The company also (perfectly legally) bought consumer datasets – on everything from magazine subscriptions to airline travel – and uniquely it appended these with the psych data to voter files. It matched all this information to people’s addresses, their phone numbers and often their email addresses. “The goal is to capture every single aspect of every voter’s information environment,” said David. “And the personality data enabled Cambridge Analytica to craft individual messages.”

Finding “persuadable” voters is key for any campaign and with its treasure trove of data, Cambridge Analytica could target people high in neuroticism, for example, with images of immigrants “swamping” the country. The key is finding emotional triggers for each individual voter.

Cambridge Analytica worked on campaigns in several key states for a Republican political action committee. Its key objective, according to a memo the Observer has seen, was “voter disengagement” and “to persuade Democrat voters to stay at home”: a profoundly disquieting tactic. It has previously been claimed that suppression tactics were used in the campaign, but this document provides the first actual evidence.

But does it actually work? One of the criticisms that has been levelled at my and others’ articles is that Cambridge Analytica’s “special sauce” has been oversold. Is what it is doing any different from any other political consultancy?

“It’s not a political consultancy,” says David. “You have to understand this is not a normal company in any way. I don’t think Mercer even cares if it ever makes any money. It’s the product of a billionaire spending huge amounts of money to build his own experimental science lab, to test what works, to find tiny slivers of influence that can tip an election. Robert Mercer did not invest in this firm until it ran a bunch of pilots – controlled trials. This is one of the smartest computer scientists in the world. He is not going to splash $15m on bullshit.”

Tamsin Shaw, an associate professor of philosophy at New York University, helps me understand the context. She has researched the US military’s funding and use of psychological research for use in torture. “The capacity for this science to be used to manipulate emotions is very well established. This is military-funded technology that has been harnessed by a global plutocracy and is being used to sway elections in ways that people can’t even see, don’t even realise is happening to them,” she says. “It’s about exploiting existing phenomenon like nationalism and then using it to manipulate people at the margins. To have so much data in the hands of a bunch of international plutocrats to do with it what they will is absolutely chilling.

“We are in an information war and billionaires are buying up these companies, which are then employed to go to work in the heart of government. That’s a very worrying situation.”

A project that Cambridge Analytica carried out in Trinidad in 2013 brings all the elements in this story together. Just as Robert Mercer began his negotiations with SCL boss Alexander Nix about an acquisition, SCL was retained by several government ministers in Trinidad and Tobago. The brief involved developing a micro-targeting programme for the governing party of the time. And AggregateIQ – the same company involved in delivering Brexit for Vote Leave – was brought in to build the targeting platform.

David said: “The standard SCL/CA method is that you get a government contract from the ruling party. And this pays for the political work. So, it’s often some bullshit health project that’s just a cover for getting the minister re-elected. But in this case, our government contacts were with Trinidad’s national security council.”

The security work was to be the prize for the political work. Documents seen by the Observer show that this was a proposal to capture citizens’ browsing history en masse, recording phone conversations and applying natural language processing to the recorded voice data to construct a national police database, complete with scores for each citizen on their propensity to commit crime.

“The plan put to the minister was Minority Report. It was pre-crime. And the fact that Cambridge Analytica is now working inside the Pentagon is, I think, absolutely terrifying,” said David.

These documents throw light on a significant and under-reported aspect of the Trump administration. The company that helped Trump achieve power in the first place has now been awarded contracts in the Pentagon and the US state department. Its former vice-president Steve Bannon now sits in the White House. It is also reported to be in discussions for “military and homeland security work”.

In the US, the government is bound by strict laws about what data it can collect on individuals. But, for private companies anything goes. Is it unreasonable to see in this the possible beginnings of an authoritarian surveillance state?

A state that is bringing corporate interests into the heart of the administration. Documents detail Cambridge Analytica is involved with many other right-leaning billionaires, including Rupert Murdoch. One memo references Cambridge Analytica trying to place an article with a journalist in Murdoch’s Wall Street Journal: “RM re-channeled and connected with Jamie McCauley from Robert Thomson News Corp office,” it says.

It makes me think again about the story involving Sophie Schmidt, Cambridge Analytica and Palantir. Is it a telling detail, or is it a clue to something else going on? Cambridge Analytica and Palantir both declined to comment for this article on whether they had any relationship. But witnesses and emails confirm that meetings between Cambridge Analytica and Palantir took place in 2013. The possibility of a working relationship was at least discussed.

Further documents seen by the Observer confirm that at least one senior Palantir employee consulted with Cambridge Analytica in relation to the Trinidad project and later political work in the US. But at the time, I’m told, Palantir decided it was too much of a reputational risk for a more formal arrangement. There was no upside to it. Palantir is a company that is trusted to handle vast datasets on UK and US citizens for GCHQ and the NSA, as well as many other countries.

Now though, they are both owned by ideologically aligned billionaires: Robert Mercer and Peter Thiel. The Trump campaign has said that Thiel helped it with data. A campaign that was led by Steve Bannon, who was then at Cambridge Analytica.

A leading QC who spends a lot of time in the investigatory powers tribunal said that the problem with this technology was that it all depended on whose hands it was in.

“On the one hand, it’s being done by companies and governments who say ‘you can trust us, we are good and democratic and bake cakes at the weekend’. But then the same expertise can also be sold on to whichever repressive regime.”

In Britain, we still trust our government. We respect our authorities to uphold our laws. We trust the rule of law. We believe we live in a free and fair democracy. Which is what, I believe, makes the last part of this story so profoundly unsettling.

Donald Trump with Peter Thiel, one of his key Silicon Valley supporters. Photograph: Drew Angerer/Getty Images

The details of the Trinidad project finally unlocked the mystery that was AggregateIQ. Trinidad was SCL’s first project using big data for micro-targeting before the firm was acquired by Mercer. It was the model that Mercer was buying into. And it brought together all the players: the Cambridge psychologist Aleksandr Kogan, AggregateIQ, Chris Wylie, and two other individuals who would play a role in this story: Mark Gettleson, a focus group expert who had previously worked for the Lib Dems. And Thomas Borwick, the son of Victoria Borwick, the Conservative MP for Kensington.

When my article linking Mercer and Leave.EU was published in February, no one was more upset about it than former Tory adviser Dominic Cummings, the campaign strategist for Vote Leave. He launched an irate Twitter tirade. The piece was “full of errors & itself spreads disinformation” “CA had ~0% role in Brexit referendum”.

A week later the Observer revealed AggregateIQ’s possible link to Cambridge Analytica. Cummings’s Twitter feed went quiet. He didn’t return my messages or my emails.

Questions had already been swirling about whether there had been any coordination between the Leave campaigns. In the week before the referendum, Vote Leave donated money to two other Leave groups – £625,000 to BeLeave, run by fashion student Darren Grimes, and £100,000 to Veterans for Britain, who both then spent this money with AggregateIQ.

The Electoral Commission has written to AggregateIQ. A source close to the investigation said that AggregateIQ responded by saying it had signed a non-disclosure agreement. And since it was outside British jurisdiction, that was the end of it. Vote Leave refers to this as the Electoral Commission giving it “a clean bill of health”.

On his blog, Dominic Cummings has written thousands of words about the referendum campaign. What is missing is any details about his data scientists. He “hired physicists” is all he’ll say. In the books on Brexit, other members of the team talk about “Dom’s astrophysicists”, who he kept “a tightly guarded secret”. They built models, using data “scraped” off Facebook.

Finally, after weeks of messages, he sent me an email. We were agreed on one thing, it turned out. He wrote: “The law/regulatory agencies are such a joke the reality is that anybody who wanted to cheat the law could do it easily without people realising.” But, he says, “by encouraging people to focus on non-stories like Mercer’s nonexistent role in the referendum you are obscuring these important issues”.

And to finally answer the question about how Vote Leave found this obscure Canadian company on the other side of the planet, he wrote: “Someone found AIQ [AggregateIQ] on the internet and interviewed them on the phone then told me – let’s go with these guys. They were clearly more competent than any others we’d spoken to in London.”

The most unfortunate aspect of this – for Dominic Cummings – is that this isn’t credible. It’s the work of moments to put a date filter on Google search and discover that in late 2015 or early 2016, there are no Google hits for “Aggregate IQ”. There is no press coverage. No random mentions. It doesn’t even throw up its website. I have caught Dominic Cummings in what appears to be an alternative fact.

But what is an actual fact is that Gettleson and Borwick, both previously consultants for SCL and Cambridge Analytica, were both core members of the Vote Leave team. They’re both in the official Vote Leave documents lodged with the Electoral Commission, though they coyly describe their previous work for SCL/Cambridge Analytica as “micro-targeting in Antigua and Trinidad” and “direct communications for several PACs, Senate and Governor campaigns”.

And Borwick wasn’t just any member of the team. He was Vote Leave’s chief technology officer.

This story may involve a complex web of connections, but it all comes back to Cambridge Analytica. It all comes back to Mercer. Because the connections must have been evident. “AggregateIQ may not have belonged to the Mercers but they exist within his world,” David told me. “Almost all of their contracts came from Cambridge Analytica or Mercer. They wouldn’t exist without them. During the whole time the referendum was going on, they were working every day on the [Ted] Cruz campaign with Mercer and Cambridge Analytica. AggregateIQ built and ran Cambridge Analytica’s database platforms.”

The details of the Trinidad project finally unlocked the mystery that was AggregateIQ. Trinidad was SCL’s first project using big data for micro-targeting before the firm was acquired by Mercer. It was the model that Mercer was buying into. And it brought together all the players: the Cambridge psychologist Aleksandr Kogan, AggregateIQ, Chris Wylie, and two other individuals who would play a role in this story: Mark Gettleson, a focus group expert who had previously worked for the Lib Dems. And Thomas Borwick, the son of Victoria Borwick, the Conservative MP for Kensington.

When my article linking Mercer and Leave.EU was published in February, no one was more upset about it than former Tory adviser Dominic Cummings, the campaign strategist for Vote Leave. He launched an irate Twitter tirade. The piece was “full of errors & itself spreads disinformation” “CA had ~0% role in Brexit referendum”.

A week later the Observer revealed AggregateIQ’s possible link to Cambridge Analytica. Cummings’s Twitter feed went quiet. He didn’t return my messages or my emails.

Questions had already been swirling about whether there had been any coordination between the Leave campaigns. In the week before the referendum, Vote Leave donated money to two other Leave groups – £625,000 to BeLeave, run by fashion student Darren Grimes, and £100,000 to Veterans for Britain, who both then spent this money with AggregateIQ.

The Electoral Commission has written to AggregateIQ. A source close to the investigation said that AggregateIQ responded by saying it had signed a non-disclosure agreement. And since it was outside British jurisdiction, that was the end of it. Vote Leave refers to this as the Electoral Commission giving it “a clean bill of health”.

On his blog, Dominic Cummings has written thousands of words about the referendum campaign. What is missing is any details about his data scientists. He “hired physicists” is all he’ll say. In the books on Brexit, other members of the team talk about “Dom’s astrophysicists”, who he kept “a tightly guarded secret”. They built models, using data “scraped” off Facebook.

Finally, after weeks of messages, he sent me an email. We were agreed on one thing, it turned out. He wrote: “The law/regulatory agencies are such a joke the reality is that anybody who wanted to cheat the law could do it easily without people realising.” But, he says, “by encouraging people to focus on non-stories like Mercer’s nonexistent role in the referendum you are obscuring these important issues”.

And to finally answer the question about how Vote Leave found this obscure Canadian company on the other side of the planet, he wrote: “Someone found AIQ [AggregateIQ] on the internet and interviewed them on the phone then told me – let’s go with these guys. They were clearly more competent than any others we’d spoken to in London.”

The most unfortunate aspect of this – for Dominic Cummings – is that this isn’t credible. It’s the work of moments to put a date filter on Google search and discover that in late 2015 or early 2016, there are no Google hits for “Aggregate IQ”. There is no press coverage. No random mentions. It doesn’t even throw up its website. I have caught Dominic Cummings in what appears to be an alternative fact.

But what is an actual fact is that Gettleson and Borwick, both previously consultants for SCL and Cambridge Analytica, were both core members of the Vote Leave team. They’re both in the official Vote Leave documents lodged with the Electoral Commission, though they coyly describe their previous work for SCL/Cambridge Analytica as “micro-targeting in Antigua and Trinidad” and “direct communications for several PACs, Senate and Governor campaigns”.

And Borwick wasn’t just any member of the team. He was Vote Leave’s chief technology officer.

This story may involve a complex web of connections, but it all comes back to Cambridge Analytica. It all comes back to Mercer. Because the connections must have been evident. “AggregateIQ may not have belonged to the Mercers but they exist within his world,” David told me. “Almost all of their contracts came from Cambridge Analytica or Mercer. They wouldn’t exist without them. During the whole time the referendum was going on, they were working every day on the [Ted] Cruz campaign with Mercer and Cambridge Analytica. AggregateIQ built and ran Cambridge Analytica’s database platforms.”

Illustration: James Melaugh

Illustration: James MelaughCummings won’t say who did his modelling. But invoices lodged with the Electoral Commission show payments to a company called Advanced Skills Institute. It takes me weeks to spot the significance of this because the company is usually referred to as ASI Data Science, a company that has a revolving cast of data scientists who have gone on to work with Cambridge Analytica and vice versa. There are videos of ASI data scientists presenting Cambridge Analytica personality models and pages for events the two companies have jointly hosted. ASI told the Observer it had no formal relationship with Cambridge Analytica.

Here’s the crucial fact: during the US primary elections, Aggregate IQ signed away its intellectual property (IP). It didn’t own its IP: Robert Mercer did. For AggregateIQ to work with another campaign in Britain, the firm would have to have had the express permission of Mercer. Asked if it would make any comment on financial or business links between “Cambridge Analytica, Robert Mercer, Steve Bannon, AggregateIQ, Leave.EU and Vote Leave”, a spokesperson for Cambridge Analytica said: “Cambridge Analytica did no paid or unpaid work for Leave.EU.”

This story isn’t about cunning Dominic Cummings finding a few loopholes in the Electoral Commission’s rules. Finding a way to spend an extra million quid here. Or (as the Observer has also discovered )underdeclaring the costs of his physicists on the spending returns by £43,000. This story is not even about what appears to be covert coordination between Vote Leave and Leave.EU in their use of AggregateIQ and Cambridge Analytica. It’s about how a motivated US billionaire – Mercer and his chief ideologue, Bannon – helped to bring about the biggest constitutional change to Britain in a century.

Because to understand where and how Brexit is connected to Trump, it’s right here. These relationships, which thread through the middle of Cambridge Analytica, are the result of a transatlantic partnership that stretches back years. Nigel Farage and Bannon have been close associates since at least 2012. Bannon opened the London arm of his news website Breitbart in 2014 to support Ukip – the latest front “in our current cultural and political war”, he told the New York Times.

Britain had always been key to Bannon’s plans, another ex-Cambridge Analytica employee told me on condition of anonymity. It was a crucial part of his strategy for changing the entire world order.

“He believes that to change politics, you have to first change the culture. And Britain was key to that. He thought that where Britain led, America would follow. The idea of Brexit was hugely symbolically important to him.”

On 29 March, the day article 50 was triggered, I called one of the smaller campaigns, Veterans for Britain. Cummings’s strategy was to target people in the last days of the campaign and Vote Leave gave the smaller group £100,000 in the last week. A small number of people they identified as “persuadable” were bombarded with more than a billion ads, the vast majority in the last few days.

I asked David Banks, Veterans for Britain’s head of communications, why they spent the money with AggregateIQ.

“I didn’t find AggegrateIQ. They found us. They rang us up and pitched us. There’s no conspiracy here. They were this Canadian company which was opening an office in London to work in British politics and they were doing stuff that none of the UK companies could offer. Their targeting was based on a set of technologies that hadn’t reached the UK yet. A lot of it was proprietary, they’d found a way of targeting people based on behavioural insights. They approached us.”

It seems clear to me that David Banks didn’t know there might have been anything untoward about this. He’s a patriotic man who believes in British sovereignty and British values and British laws. I don’t think knew about any overlap with these other campaigns. I can only think that he was played.

And that we, the British people, were played. In his blog, Dominic Cummings writes that Brexit came down to “about 600,000 people – just over 1% of registered voters”. It’s not a stretch to believe that a member of the global 1% found a way to influence this crucial 1% of British voters. The referendum was an open goal too tempting a target for US billionaires not to take a clear shot at. Or I should say US billionaires and other interested parties, because in acknowledging the transatlantic links that bind Britain and America, Brexit and Trump, so tightly, we also must acknowledge that Russia is wrapped somewhere in this tight embrace too.

For the last month, I’ve been writing about the links between the British right, the Trump administration and the European right. And these links lead to Russia from multiple directions. Between Nigel Farage and Donald Trump and Cambridge Analytica.

A map shown to the Observer showing the many places in the world where SCL and Cambridge Analytica have worked includes Russia, Lithuania, Latvia, Ukraine, Iran and Moldova. Multiple Cambridge Analytica sources have revealed other links to Russia, including trips to the country, meetings with executives from Russian state-owned companies, and references by SCL employees to working for Russian entities.

Article 50 has been triggered. AggregateIQ is outside British jurisdiction. The Electoral Commission is powerless. And another election, with these same rules, is just a month away. It is not that the authorities don’t know there is cause for concern. The Observer has learned that the Crown Prosecution Service did appoint a special prosecutor to assess whether there was a case for a criminal investigation into whether campaign finance laws were broken. The CPS referred it back to the electoral commission. Someone close to the intelligence select committee tells me that “work is being done” on potential Russian interference in the referendum.

Gavin Millar, a QC and expert in electoral law, described the situation as “highly disturbing”. He believes the only way to find the truth would be to hold a public inquiry. But a government would need to call it. A government that has just triggered an election specifically to shore up its power base. An election designed to set us into permanent alignment with Trump’s America.

Martin Moore of King’s College, London, pointed out that elections were a newly fashionable tool for would-be authoritarian states. “Look at Erdoğan in Turkey. What Theresa May is doing is quite anti-democratic in a way. It’s about enhancing her power very deliberately. It’s not about a battle of policy between two parties.”

This is Britain in 2017. A Britain that increasingly looks like a “managed” democracy. Paid for by a US billionaire. Using military-style technology. Delivered by Facebook. And enabled by us. If we let this referendum result stand, we are giving it our implicit consent. This isn’t about Remain or Leave. It goes far beyond party politics. It’s about the first step into a brave, new, increasingly undemocratic world.

Key names

SCL Group

British company with 25 years experience in military “psychological operations” and “election management”.

Cambridge Analytica

Data analytics company formed in 2014. Robert Mercer owns 90%. SCL owns 10%. Carried out major digital targeting campaigns for Donald Trump campaign, Ted Cruz’s nomination campaign and multiple other US Republican campaigns – mostly funded by Mercer. Gave Nigel Farage’s Leave.EU “help” during referendum.

Robert Mercer

US billionaire hedge fund owner who was Trump’s biggest donor. Owns Cambridge Analytica and the IP [intellectual property] ofAggregateIQ. Friend of Farage. Close associate of Steve Bannon.

Steve Bannon

Trump’s chief strategist. Vice-president of Cambridge Analytica during referendum period. Friend of Farage.

Alexander Nix

Director of Cambridge Analytica and SCL Group.

Christopher Wylie

Canadian who first brought data expertise and microtargeting to Cambridge Analytica; recruited AggregateIQ.

AggregateIQ

Data analytics company based in Victoria, British Columbia, Canada. Worked for Mercer-funded Pacs that supported the Trump campaign. Robert Mercer owns AggregateIQ’s IP. Paid £3.9m by Vote Leave to “micro-target” voters on social media during referendum campaign. Outside British jurisdiction.

Veterans for Britain

Given £100,000 by Vote Leave. Spent it with AggregateIQ.

BeLeave

Youth Leave campaign set up by 23-year-old student. Given £625,000 by Vote Leave & £50,000 by another donor. Spent it with AggregateIQ.

DUP

Democratic Unionist Party of Northern Ireland. Spent £32,750 with AggregrateIQ.

Thomas Borwick

Vote Leave’s chief technology officer. Previously worked with SCL/Cambridge Analytica and AggregateIQ.

ASI Data Science

Data science specialists. Links with Cambridge Analytica, including staff moving between the two and holding joint events. Paid £114,000 by Vote Leave. Vote Leave declared £71,000 to Electoral Commission.

Donald Trump

US president. Campaign funded by Mercer and run by Bannon. Data services supplied by Cambridge Analytica and AggregrateIQ.

Nigel Farage

Former Ukip leader. Leader of Leave.EU. Friend of Trump, Mercer and Bannon.

Arron Banks

Bristol businessman. Co-founder of Leave.EU. Owns data company and insurance firm. Single biggest donor to Leave – £7.5m.

Friday 17 February 2017

It's not Paul Nuttall's fault he made a mistake about Hillsborough

Mark Steel in The Independent

Some people have criticised the Ukip leader Paul Nuttall, as his website claimed he lost a “personal friend” at Hillsborough, but now he accepts that isn’t true. But we should be understanding, as life can be deeply unsettling for sufferers of “Deceased Close Personal Friend/Someone I Vaguely Knew Back-to-Front Syndrome”.

It must be an awful ordeal as he breaks down every time he reads an obituary, crying, “oh no, Gabriel Santana Lopez has died, he was a close personal friend”, until it’s pointed out he was a 93-year-old Chilean jazz clarinettist who Paul had never heard of, then he calms down for a while.

We should hope he never risks seeing a Shakespeare play. He’ll be devastated for weeks, writing, “I can’t believe Tiberius has been poisoned”, on his website until he’s reminded it was a play and he had no idea who that is.

Walking through graveyards must be a dreadful trial, as he stops by each gravestone, sobbing “oh no, not Beloved Amy Chadwick 1843-1911, she was a close personal friend. Why, why, why?”

Paul’s explanation for the false claim of personal friendship is he never said it in the first place, it was just on his website. This seems reasonable, as you can hardly be expected to keep track of things you say on your own website.

My one probably says I played in the water polo final at the Olympics and I’ve got a license to pilot rockets – I’m too busy to check.

This is an exciting development in the art of responding to a suspicion you’ve said something untrue. Instead of apologising or saying you were under stress, you claim it wasn’t really you who said it. The next stage will be for a politician to say “I reject the charge that I lied because those words I said weren’t mine. They were actually someone else’s words and they were in my mouth, and I had no idea they were being said by me at the time I said them.”

Or maybe Ukip allow people to write stuff on websites by guesswork, without the person whose website it is having any say, so a random person may write “Douglas Carswell speaks Portuguese and keeps llamas” because there’s always a chance they’ll be right.

It’s also possible that when the person who writes Paul’s website applied for the job, they claimed they were well qualified as they were his close personal friend, even though they’d only met him once, in a queue at a tweed jacket store in Bootle.

Paul also claims he was at Hillsborough on the day of the tragedy, and maybe he was. But teachers, friends and colleagues of his say they can’t recall him ever mentioning he was there at the time. The most likely explanation is he must have been at other places as well that day, and he can’t be expected to have recalled being in a major tragedy and popping to the Co-op for some milk.

Another reason Paul wouldn’t have been keen to mention his presence there that day is Arron Banks, Ukip’s largest donor, has said he’s “sick to death” of hearing about Hillsborough. So the last thing Paul would want is to annoy his party’s donor by mentioning he’d been there.

The reason the Ukip donor was fed up of Hillsborough, he said, is “It was a disaster and that’s it” and “milking a tragedy forever is sick”.

It’s possible the reason Arron Banks is sick of hearing about disasters is that Paul Nuttall tells him every day about all the close personal friends he lost on the Titanic and poor Arron has finally had enough.

But even though we can’t know whether Paul was there, it might not matter any more. Because this is the age of the alternative fact, when there’s no embarrassment about getting caught having lied. Farage can claim the Health Service is crippled by Aids tourists, Boris can claim leaving the EU will bring £350m a week to the NHS, and when they’re told this isn’t true, they’ll say “Well no, the reason the records show the opposite is true to what I claimed, is I lied. But that doesn’t alter the truth about the thing I made up.”

In this new world, if you disprove nonsense that’s been made up, that goes to show you’re part of the elite, with your fancy facts and la-di-da evidence.

So down-to-earth types like Paul Nuttall are at last free to put forward the working man’s case. Now, if he likes, he can write on his website that the Prime Minister of Bulgaria has been creeping round Hampshire, encouraging Bulgarians to shave British cats and smoke their fur as a legal high, or that a study has proved Muslims are thirty per cent gelignite which is why they feel the need to explode.

Or that unicorns died out because they were banned by the EU on grounds of health and safety for being too pointy.

He can clarify his outlook by writing “I object strongly to the charge that my views are in any way racist, as I was a black man for six years while I was a Spitfire pilot in the Second World War, including three months as a Rastafarian until my dreadlocks got caught in the propellers.”

None of it matters, because we’re at last liberated from the stifling constraints of truth. Rather than apologise, Paul Nuttall should make the most of this new situation, and before the election in Stoke claim he’s always felt connected to the area, since he was at the great Stoke pottery disaster of 1809, in which he lost a personal friend whose head got stuck in a Wedgwood vase.

Some people have criticised the Ukip leader Paul Nuttall, as his website claimed he lost a “personal friend” at Hillsborough, but now he accepts that isn’t true. But we should be understanding, as life can be deeply unsettling for sufferers of “Deceased Close Personal Friend/Someone I Vaguely Knew Back-to-Front Syndrome”.

It must be an awful ordeal as he breaks down every time he reads an obituary, crying, “oh no, Gabriel Santana Lopez has died, he was a close personal friend”, until it’s pointed out he was a 93-year-old Chilean jazz clarinettist who Paul had never heard of, then he calms down for a while.

We should hope he never risks seeing a Shakespeare play. He’ll be devastated for weeks, writing, “I can’t believe Tiberius has been poisoned”, on his website until he’s reminded it was a play and he had no idea who that is.

Walking through graveyards must be a dreadful trial, as he stops by each gravestone, sobbing “oh no, not Beloved Amy Chadwick 1843-1911, she was a close personal friend. Why, why, why?”

Paul’s explanation for the false claim of personal friendship is he never said it in the first place, it was just on his website. This seems reasonable, as you can hardly be expected to keep track of things you say on your own website.

My one probably says I played in the water polo final at the Olympics and I’ve got a license to pilot rockets – I’m too busy to check.

This is an exciting development in the art of responding to a suspicion you’ve said something untrue. Instead of apologising or saying you were under stress, you claim it wasn’t really you who said it. The next stage will be for a politician to say “I reject the charge that I lied because those words I said weren’t mine. They were actually someone else’s words and they were in my mouth, and I had no idea they were being said by me at the time I said them.”

Or maybe Ukip allow people to write stuff on websites by guesswork, without the person whose website it is having any say, so a random person may write “Douglas Carswell speaks Portuguese and keeps llamas” because there’s always a chance they’ll be right.

It’s also possible that when the person who writes Paul’s website applied for the job, they claimed they were well qualified as they were his close personal friend, even though they’d only met him once, in a queue at a tweed jacket store in Bootle.

Paul also claims he was at Hillsborough on the day of the tragedy, and maybe he was. But teachers, friends and colleagues of his say they can’t recall him ever mentioning he was there at the time. The most likely explanation is he must have been at other places as well that day, and he can’t be expected to have recalled being in a major tragedy and popping to the Co-op for some milk.

Another reason Paul wouldn’t have been keen to mention his presence there that day is Arron Banks, Ukip’s largest donor, has said he’s “sick to death” of hearing about Hillsborough. So the last thing Paul would want is to annoy his party’s donor by mentioning he’d been there.

The reason the Ukip donor was fed up of Hillsborough, he said, is “It was a disaster and that’s it” and “milking a tragedy forever is sick”.

It’s possible the reason Arron Banks is sick of hearing about disasters is that Paul Nuttall tells him every day about all the close personal friends he lost on the Titanic and poor Arron has finally had enough.

But even though we can’t know whether Paul was there, it might not matter any more. Because this is the age of the alternative fact, when there’s no embarrassment about getting caught having lied. Farage can claim the Health Service is crippled by Aids tourists, Boris can claim leaving the EU will bring £350m a week to the NHS, and when they’re told this isn’t true, they’ll say “Well no, the reason the records show the opposite is true to what I claimed, is I lied. But that doesn’t alter the truth about the thing I made up.”

In this new world, if you disprove nonsense that’s been made up, that goes to show you’re part of the elite, with your fancy facts and la-di-da evidence.

So down-to-earth types like Paul Nuttall are at last free to put forward the working man’s case. Now, if he likes, he can write on his website that the Prime Minister of Bulgaria has been creeping round Hampshire, encouraging Bulgarians to shave British cats and smoke their fur as a legal high, or that a study has proved Muslims are thirty per cent gelignite which is why they feel the need to explode.

Or that unicorns died out because they were banned by the EU on grounds of health and safety for being too pointy.

He can clarify his outlook by writing “I object strongly to the charge that my views are in any way racist, as I was a black man for six years while I was a Spitfire pilot in the Second World War, including three months as a Rastafarian until my dreadlocks got caught in the propellers.”

None of it matters, because we’re at last liberated from the stifling constraints of truth. Rather than apologise, Paul Nuttall should make the most of this new situation, and before the election in Stoke claim he’s always felt connected to the area, since he was at the great Stoke pottery disaster of 1809, in which he lost a personal friend whose head got stuck in a Wedgwood vase.

Tuesday 28 July 2015

Greek debt crisis: A tale of ritual humiliation

Mark Steel in The Independent

What a relief that the Greeks have finally seen sense, and agreed to Angela Merkel’s demand that their Prime Minister Alexis Tsipras must scrub Berlin with a dishcloth, and crawl along the banks of the Rhine in a thong barking like a dog.

The week before he’d agreed to dress as a fairy and sing “The Good Ship Lollipop” while German children poked him with stinging nettles, but now that isn’t enough. So he has to accept even more measures essential to stabilising the Greek economy, such as being hosed down with kebab fat while naming the German squad that won the 1954 World Cup.

Otherwise, as EU leaders made clear, there would be no way Greece could stay inside the solar system; they’d have to orbit a different star in a faraway galaxy, which could be extremely damaging to the Greek tourist industry.

Instead of inviting further chaos by leaving Greece in the hands of the Greeks, their finances have been handed over entirely to the only people we can trust to behave responsibly at all times: the banks. Thank the Lord we’ve got at least one institution that has never behaved irresponsibly or recklessly in any way.

Perhaps the Greeks should have gone to Brussels and said they were rebranding Greece, so it’s no longer a country, but a bank. They’d have been bailed out by lunch and given a free set of steak knives as an extra gift. Instead they’ve got to sell off their entire country. By Christmas you’ll be able to buy a family ticket for 300 quid to visit the Domino’s Parthenon, where you can watch a parade of philosophers dressed as your favourite pizzas, with Pythagoras pepperoni proving a particular favourite, then scream your way down the Acropolis on a log flume.

One of the main demands in the final deal is that the Greek state must sell off €50bn-worth of its assets, which amounts to everything it has. This is part of the drive to make the economy stable and efficient. This works as long as you assume privatisation unarguably makes an industry more efficient. Obviously there are examples such as the railways in Britain, where privatisation has resulted in cheap reliable trains on which you can always get a seat, it’s easy to buy tickets across different rail networks, and customers are even offered delightful unscheduled 40-minute stops outside London Bridge station to give you the opportunity to paint the view of a gasworks in Bermondsey.

The demands placed on Greece are so extreme that even the International Monetary Fund has declared them “unsustainable”. The IMF is the body that has spent 50 years forcing countries such as Tanzania and Haiti to cut wages and sell off its possessions, in return for loans it needs so it can pay off the interest on the last lot of money it borrowed (from the IMF). So when it says the demands on Greece are too harsh, it’s like making the leader of Isis say, “Steady on, that’s a bit too Islamic”.

Still, someone has to tell the Greeks they can’t expect to carry on getting something for nothing. And the European Central Bank and national central banks – who, according to the Jubilee Debt Campaign, “stand to make between €10bn and €22bn out of Greek repayments” – are exactly the right people to deliver that stern but fair message.

Christine Lagarde, managing director of the IMF, is paid a salary of €550,000 a year, and by special arrangement pays no tax on that whatsoever. So she’s certainly the right person to lecture the Greeks, because she’s never been behind on her tax payments once. Every month she dutifully pays her nothing bang on time; she understands the importance of behaving responsibly with public money.

The most perplexing part of this story is that, a few days ago, it seemed as if Alexis Tsipras and his party, Syriza, were set to resist the orders being thrown at them, especially as they’d gone to the trouble of winning a referendum on whether to accept the EU demands. I suppose Tsipras thought that when the majority of Greeks voted against, it was because they felt those demands weren’t harsh enough, and they deserved to be punished much more severely as they’d all been very naughty.

Because Tsipras went into negotiations making it clear he was desperate to keep Greece in the eurozone, the EU could demand whatever it liked, knowing he’d accept anything rather than abandon the euro.

That sounds like going into a car showroom and saying, “I desperately need a car right now and I’ll have anything rather than leave without one”. A salesman could say, “We’ve only got this one, it’s got no engine and the windscreen’s made of wood and it pongs as a family of weasels live on the back seat and the bonnet’s on fire, it’s £10,000”, and you’d have no choice but to take it.

But maybe he did have a choice, to tell the banks they’ve made plenty out of Greece as it is and so, on balance, the elected government had decided to go along with what the Greeks voted for twice in a few months – wasting their money on schools and old people in villages, rather than do the sensible thing and hand over every coin as interest payments to institutions such as Goldman Sachs.

They’d have been kicked out of the eurozone, and probably out of Uefa and the Eurovision Song Contest, and scratched off the Inter-rail map too. But they’d have been a little beacon for everyone across Europe who feels the banks aren’t acting entirely in our interests, probably enough people to worry Angela Merkel just a bit.

What a relief that the Greeks have finally seen sense, and agreed to Angela Merkel’s demand that their Prime Minister Alexis Tsipras must scrub Berlin with a dishcloth, and crawl along the banks of the Rhine in a thong barking like a dog.

The week before he’d agreed to dress as a fairy and sing “The Good Ship Lollipop” while German children poked him with stinging nettles, but now that isn’t enough. So he has to accept even more measures essential to stabilising the Greek economy, such as being hosed down with kebab fat while naming the German squad that won the 1954 World Cup.

Otherwise, as EU leaders made clear, there would be no way Greece could stay inside the solar system; they’d have to orbit a different star in a faraway galaxy, which could be extremely damaging to the Greek tourist industry.

Instead of inviting further chaos by leaving Greece in the hands of the Greeks, their finances have been handed over entirely to the only people we can trust to behave responsibly at all times: the banks. Thank the Lord we’ve got at least one institution that has never behaved irresponsibly or recklessly in any way.